Supervised by: Bert McLelland MA, BA. Bert has just completed his second Master’s degree in Public Policy at King’s College, London. As well as earning his first Master’s in Rhetoric and Political Discourse and Bachelor’s in Political Theatre, Bert was the digital strategist for a prominent Congress campaign, media director during a successful Senatorial campaign, and a graduate teaching assistant at the University of Alabama. His research interests are wide-reaching, and relate to ideas of performance, micro- and macro-economics and politics, amongst other things.

Abstract

The new sanctions placed by the West on Russia have contributed to many devastating effects on both sides, causing both parties to struggle. The explanation for this result is due to the interconnectedness of the world’s economy. With the tremendous growth of Russia’s economy in the early 2000s, the EU saw this growth as a great investment. Russia is also a major supplier of raw materials such as oil which the world is dependent on. Despite the great investment in Russia’s economy, the power it now holds over the UK is lessening the extent to which the UK is able to impose sanctions. We gathered our information from contemporary media coverage, peer-review articles, and government reports. We found that exports from the UK to Russia are likely to decrease, causing a larger current account deficit in the UK’s balance of payments, leaving the UK to have what is predicted to be its highest inflation rate in decades in 2023. Additionally, it is becoming increasingly difficult for individuals with Russian connections in the UK to do business, which may have knock-on effects on the UK economy as a whole. Our findings indicate that imposing sanctions comes with costs for the imposing country’s well being; as a result, the policymakers of today are pressured on how to balance the harsh sanctions they will impose on Russia and the correlating damages to their citizens’ livelihood.

Introduction

Sanctions can present themselves as various limitations such as travel bans, asset freezes, or trade restrictions (Dow Jones Professional). The purpose of sanctions is for a government to put strains on another nation’s quality of life or general status of government satisfaction (Dow Jones Professional). The current goal of UK sanctions on Russia is to prevent possible escalation of the war.

Until 2020, the UK was a member of the EU, so it is important to explore EU and Russian relations as they set up the current status of the UK-Russia relationship. In 2000, at the very start of Vladamir Putin’s presidency, Russia was bankrupt (Csis.org, 2010). 10 years later, Russia’s GDP had grown 10 times larger (Csis.org, 2010). This immense growth made Russia a great candidate for foreign investment (Csis.org, 2010).

Until the illegal annexation of Crimea, the EU-Russian trade relation was strong, but in 2014 the political relation was severed (Policy.trade.ec.europa.eu). Following the annexation of Ukraine, the EU pressed down on Russia by restricting their access to firearms, dual-use goods and the technology that allowed for oil exports and production. The next month, Russia responded by banning European imports of certain food and agricultural products (Policy.trade.ec.europa.eu).

The purpose of this paper is to summarize the conflicts and the effects caused as a result of the UK and the West sanctioning Russia. Firstly, there will be a review of the past conflicts concerning the UK and Russia, going in depth on wars and other economic conflicts. Secondly, there will be a review of the sanctions currently being imposed on Russia, and how they are affecting Russia’s economy today. Finally, there will be an analysis of the various effects that such sanctioning efforts have on the UK’s economy.

History of the Sanctions

Moscow and the UK have had long-established relations, dating back to the 1950s. The mutually beneficial relationship of the nations depended on the Soviet Union storing money in accounts of London banks. The interaction allowed for profitable income and a boost to the UK’s economy (Bullough, 2022). Other nations, which had similar relations with Russia in the 1990s slowly became suspicious, unlike the UK, and eventually faded out of them (Bullough, 2022).

Now, though the UK does not depend on Russia for goods, such as oil, wheat, and precious metals, Russian oligarchs have had strong lasting roles in the UK economy (Broom, 2022). By diversifying their assets, Russian oligarchs have purchased 1 billion plus pounds worth of property in London (Bullough, 2022). Due to its great benefit to the UK economy, there was little thought put into this form of unaccountable wealth (Harris, 2022). Now, because of this ignorance, London is finally facing consequences (Harris, 2022).

In London, due to the degree of absent households which are owned by Russian oligarchs, the space left for those who live in those neighborhoods is limited (Harris, 2022). The properties are dormant and the lack of people adds up to an inability for London’s economy to thrive at the same level as it could if the action were to be taken to eliminate the growing rent and empty homes (Harris, 2022).

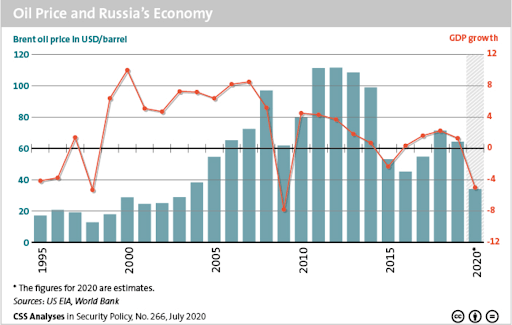

Graph of Russian GDP Growth and Oil Prices (in USD/Barrel) 1995-2020

Studies, the C. for S. (2020, June 8). Oil Price and Russia’s Economy. https://isnblog.ethz.ch/economy/oil-price-and-russias-economy [Accessed April 30, 2022]

Here is a graph of the oil prices as well as the GDP growth of Russia since 1995. There are 4 significant drops in GDP over the years. In 1998 Russia was in a financial crisis due to the crash of the ruble (Tracy 2018). The drop during the Great Recession in 2008 correlates with the drop in crude oil price as well as geopolitical factors of fear surrounding the war with Georgia. In 2014 oil prices plummeted. 60% of exports, as well as 30% of Russia’s GDP, depend on oil (Tracy, 2018). The drop was a result of a shift in demand and greater production of oil in the US (Tracy, 2018). The 2014 annexation of Crimea further damaged the Russian economy (Tracy, 2018). Finally, 2020 marks the beginning of the COVID-19 pandemic.

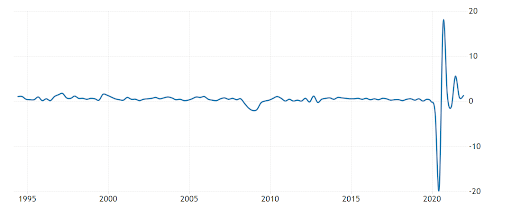

Ferreira, J. (2021, March 29). UK Q4 GDP Growth Confirmed at 0.2%.

Tradingeconomics.com; TRADING ECONOMICS. https://tradingeconomics.com/united-kingdom/gdp-growth

Over the last 30 years, the UK economy has remained quite stable with the exception of the 2008 recession and imbalances caused by the pandemic. In 2014, despite the EU’s sanctions on Russia, the economy of the UK was not significantly affected (Ferriera, 2021).

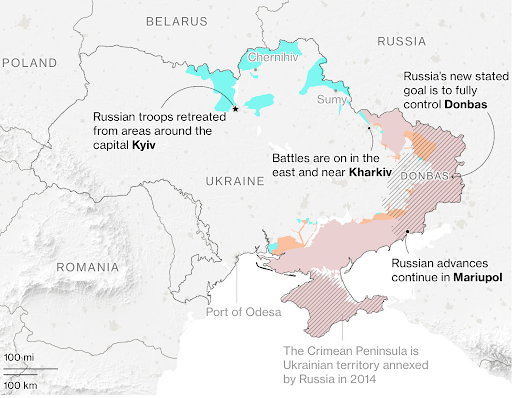

Map of 2022 Invasion of Ukraine

Above is a map depicting the progress (as of 12 April 2022) of the Russian invasion of Ukraine. In the south-most region of the country, shaded and red on the map is the Crimean Peninsula, which was annexed in 2014 by Russian forces.

During the 2014 annexation of Crimea, the motive was to gain control over areas of the former USSR and integrate regions with ethnic Russians into the current Russian state (Bullough, 2022). Due to the illegality of this act, many nations began to distance themselves from Russia politically and place sanctions on the nation (Swinford, 2022). However, the UK economy was benefiting greatly from Russian oligarchs. In hopes of attracting Russian investment, the UK did not enforce proper company registration (Swinford, 2022). Another way in which the UK lured almost £800 million from Russian oligarchs was by providing “Golden Visas” to allow them residency in the UK (Bullough, 2022). Great concern rose about near-future economic stability in the UK (Swinford, 2022). The Downing Street Paper suggested that London shut its financial center off from Russians entirely or support trade sanctions (Swinford, 2022). The risks, though previously known, were too great to input common sanctions, and instead, travel bans and restrictions on visas were imposed (Bullough, 2022).

Sanctions Placed on Russia and their Effects on Russian Economy

In contemporary society, the world has come together to combat Russia or, more precisely, Vladimir Putin. To perform such a task, the United Kingdom and the West have placed several crippling sanctions on the Russian economy. Recently, the United Kingdom has imposed various sanctions on Russia. It is necessary to understand such sanctions prior to describing their purpose and effects. Financial sanctions involve the direct freezing of assets of certain individuals and companies, specifically those who are in close proximity to Putin’s political circle (Nice, 2022). The UK has also obstructed the ability to access commercial transactions and blocked capital markets and financial services (Nice, 2022). Economic sanctions have proven to have a profound impact on the Russian economy as the largest messaging system used by banks across the globe to make rapid and secure cross border pavements, SWIFT, has been banned in Russia (Nice, 2022). Russia currently struggles to send and receive money from the outside world, isolated economically (Inman, 2022). With hundreds of billions of dollars frozen, notably by the banks of Sberbank and VTB, Russia is in a position in which they do not have access to substantial amounts of money and face a strong coalition between the western states (Inman, 2022).

Currently, the sanctions placed on immigration block all Russian nationals from entering as a precaution, since the infiltration of an intruder or spy would be detrimental (Russia: Borders Closed to Foreign Nationals, 2022). Russia has followed this by closing its borders from 1 March to 1 May; however, it is possible that we will see additional restrictions (Russia: Borders Closed to Foreign Nationals, 2022). Due to the refusal of UK visitors to Russia, Russia’s economy has been decreasing; without visitors, there are fewer tourists to purchase products and occupy hotels while on their stay (Russia: Borders Closed to Foreign Nationals, 2022). There are fewer workers in the workforce, and with a sanction on immigration in place, Russia loses individuals who would move in search of better job opportunities (Constable, 2022). It is evident that Russia’s diversity will decrease, as a result; there will be a smaller population of workers, less overall talent and intellectuals, giving rise to a less diverse and lacking market (Constable, 2022).

With the UK’s sanctions on trade, in Russia’s now lacking market, all imports or exports of goods are greatly reduced in number. In 2020, 45% of all Russian exports were bound for NATO countries, and they received almost 40% of their imports from NATO (Cygan et al., 2022). As a result of newly installed trade sanctions, Russia has now lost almost half of its potential trade opportunities. This is important because the imports of technology and consumer goods, on which Russia is heavily reliant, have been cut off (Cygan et al., 2022). Russia is in a critical state where the many essential resources usually provided by NATO countries are now inaccessible; this situation can be likened to that of a siege.

These collective sanctions have disrupted and devastated the Russian economy, causing oligarchs and Putin himself to panic. Such sanctions have had devastating effects on the Russian economy. With investors in Russian markets fleeing, the value of the Russian ruble has dropped significantly. To the United Kingdom and the world’s relief, the depreciation of the ruble has hindered Russia’s ability to conquer Ukraine.

In this pivotal time, Ukraine is in desperate need of all the possible support it can garner. Ukrainian President Volodymyr Zelensky reportedly said: “I need ammunition, not a ride” (Booth et al., 2022). Although the simple solution seems to be to offer tanks and other heavy weaponry, this solution is not easy to execute. First, NATO countries are worried about the risks of becoming too involved in this issue, due to the threat of nuclear war that looms over the heads of many. Putin recently stated that he has his nuclear forces on standby in response to the “aggressive statements” and additional sanctions that are currently in place by NATO; such an ominous warning imposes a threat to the well-being of the world (Jeong, 2022). With the possibility of World War III, countries of NATO have held back on the type of support they are willing to provide Ukraine (Jeong, 2022). However, as many see such a threat as a bluff and have seen no movements in which they will use nuclear warheads, the threat is still present (Jeong, 2022).

With many variables at play, it is difficult to anticipate what will occur in the following months. The important question that is often brought up is “How long can we exercise sanctions?” It is difficult to say, however; as Russia’s influence on western countries through oil exports becomes increasingly apparent, it is predicted that by around November or December, European supplies will only be at 30% of their typical capacity (Cygan et al., 2022). Due to Russia’s large contributions to the oil market, they continue to exploit Europe’s lack of oil, treating it as their Achilles heel (Cygan et al., 2022). It is NATO’s hope that the war will not prolong past this year as Russia will start to gain an advantage due to oil being essential to every society (Cygan et al., 2022). What happens to the Russian economy in the following months all depends on NATO’s resolve to keep the current sanctions. If sanctions are held in place, Russia’s economy will continue to tank and could possibly transition from its current autocratic economy to an autarkic economy, like that of North Korea (Hess, 2022).

How Have the Sanctions Affected the UK’s Economy?

Authorities are determined to find out the extent to which the sanctions have affected the UK’s inflation rate and costs of living. The expected inflation rate for the UK starting from 1 February 2022, has an expected value of 2.3%, while the five-year forward inflation rate is estimated at approximately 0.01% (War and Sanctions Means Higher Inflation, 2022). Investors agree that the UK’s current rate of inflation is temporary. The reason for this is that the UK imported nearly 40% of its gases from Russia and with the outbreak of the war, this percentage has fallen drastically to nearly 20% (2022).

According to a poll, public support for Russian sanctions is dwindling as the cost of living issue bites. The percentage of people who would accept higher fuel prices as a result of severe Western sanctions on Russia has dropped 14% in one month, from 50% in March 2022 to 36% in April 2022 (Diver, 2022). Due to uncertainties over the crisis in Ukraine and Russian supply, global energy and gasoline prices have risen immensely since the beginning of the war and have remained high. Ministers have warned that sanctions against Russia will increase the cost of living in the United Kingdom (Diver, 2022).

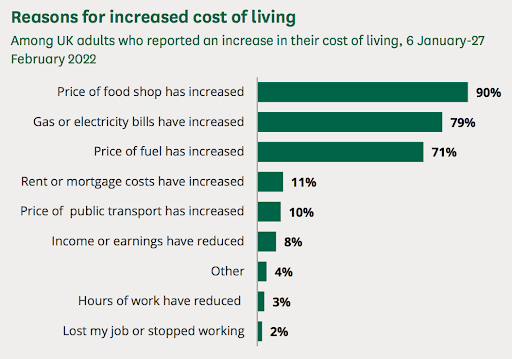

Harari, D., Devine, B. F., Bolton, P., & Keep, M. (n.d.). Rising cost of living in the UK.

House of Commons Library. Retrieved April 30, 2022, from https://researchbriefings.files.parliament.uk/documents/CBP-9428/CBP-9428.pdf

The diagram above displays UK adults’ reasoning for the increase in the cost of living, recorded from the 6 January to the 27 February 2022. Considering the diagram above and keeping in mind that the Russian invasion began on the 24 February 2022, it can be interpreted that the cost of living in the UK has three main divisions: The price of the food market with 90%, the gas and/or electricity bills with 79%, and the price of the fuel with 71%. The price increase in these categories also affects the poverty level as well as the cost of living. The rich are unlikely to be affected by these changes as they can endure such alterations. However, the middle to lower classes will be worst affected as more people will inevitably go into poverty. The other factors are not shifting the cost of living at all, as nearly they’re all 11% or less (Harari et al., 2022). Public transportation prices or mortgage costs increase can be seen at any time in any country. Evidently, having fewer working hours or having no opportunities for work at all would lead to a higher cost of living for them.

For the first time in 30 years, the UK is dealing with a major inflation problem and many people are yearning to see the inflation rate decline. Unfortunately, as long as the war goes on, it is likely that the rate of inflation will continue to rise, achieving its highest point by the end of 2022 (BBC, 2019). Food, fuel and energy are now much more expensive, widening the gap between the average price level and the minimum wage of workers, giving them insufficient income which may reduce their ability to spend on basic necessities such as food, hence leading to more poverty. The Bank of England is trying to manage the situation in its own traditional way of increasing interest rates while the public share mixed opinions on whether or not that is the best option.

How Do the Sanctions Affect Russia’s Ability to Influence the UK?

The considerable sanctions imposed by the UK and its international partners have already had a significant impact on the Russian economy and its inhabitants, and Russia confronts both a significant reduction in the size of its economy and significant inflation. The Russian economy is anticipated to suffer severe damage as a result of the existing energy restrictions (UK Parliament, 2022). If energy restrictions and demand reductions are implemented in accordance with declarations made by the US, EU, UK, and others, the economic impact on Russia might be devastating and long-lasting (2022).

Given the size of Russia’s economy and its interaction with Europe, the sanctions are unprecedented. The Committee is concerned that guidance for individuals tasked with enforcing sanctions appears to be lagging behind what is available in the United States (UK Parliament, 2022). To allow for the successful implementation of sanctions across the private sector, the government must make sure that its guidance is clear, precise, and easily accessible.

Despite producing considerable quantities of oil and gas, the United Kingdom is not immune to the economic implications of Russian oil and gas sanctions. The price of gas in the UK is determined by the level of gas demand in Europe, whereas the price of oil is determined by the worldwide price (UK Parliament, 2022). More sanctions on Russian oil and gas would result in higher prices, which will be passed on to UK consumers and businesses.

The economic sanctions imposed on Russia will have an impact on the UK economy. Although it is now impossible to estimate that cost, the Committee believes that, based on the evidence currently available (as of April 2022), it is unquestionably a cost worth enduring in order to assist Ukraine in its fight against Russian aggression (UK Parliament, 2022). However, this cost, when combined with the already existing cost of living constraints in the UK, would affect the entire country, particularly low-income households.

Trade and Exchange Rates

The sanctions are imposed to ban all exports of dual-use goods to Russia (goods that are used for both military and civil purposes). Making payments for international transactions may become more difficult through financial sanctions. This includes the removal of Russian banks from the SWIFT money messaging system (Bartrum, 2022).

Naturally, Russia sees a steep devaluation of the ruble of up to 22% (Bartrum, 2022), resulting in more expensive imports for Russian households and firms, which may ultimately reduce aggregate demand for imported goods and services. This, in turn, reduces the demand for exports from the UK to Russia. Assuming import expenditure is constant, this can lead to a larger current account deficit in the UK economy’s balance of payments. An advantage to this is that it may lower the rate of inflation in the UK, but as previously mentioned, there could be more unemployment causing worsened living standards and more poverty. To combat this, the UK government may decide to impose protectionist policies such as subsidizing the production of exported goods to lower the price of exports in an attempt to encourage more consumption of UK domestic products from Russia. Alternatively, the UK government can try to decrease spending on imports through contractionary monetary policy measures such as raising interest rates and decreasing the money supply.

Although the sanctions that followed Russia’s invasion of Ukraine could have a consequential impact on the UK economy, Russia currently does not have many direct links to the UK economically, so such policies may not have a high probability of success. This is evident as Russia only accounts for 0.7% of UK exports of goods and services and only 1.5% of imports. Furthermore, less than 4% of the UK’s gas supply is from Russia, a lower proportion than other major EU countries. However, the UK’s biggest exports to Russia are vehicles including parts, machinery and appliances, whilst precious metals, petroleum and oil were among the most imported items from Russia to the UK in 2019, the last year before the pandemic as well as the last year for which there is available data (Bartrum, 2022). In fact, Russia is the world’s leading supplier of natural gas and among the top exporters of crude oil, commodities such as wheat, and metals including gold, platinum, aluminum and palladium (Partington, 2022). According to the Financial Times, the Bank of Russia has been building up its reserves and divesting itself of dollars and dollar-denominated assets since 2014. The Russian economy’s massive current account surplus, with a $19bn difference between what Russia exports and what it imports, is a deliberate attempt to minimize the potential impact of future sanctions (Meadway, 2022). Despite the insubstantial trade actively occurring between Russia and the UK, three possible outcomes (Bartrum, 2022) may result from this disruption of trade, including:

- A limited disruption scenario: there is little disruption to energy supplies and the main impact on the UK and other European economies comes from the uncertainty of gas prices, almost completely unrelated to the Russia-Ukraine war.

- A substantial disruption scenario: Russia has the potential to push European economies, including the UK, into a recession by turning off its supply of natural gas to Europe.

- Intermediate scenarios: the many scenarios between these two extremes, where energy supply from Russia to Europe is reduced but not eliminated.

Dependent Manufacturers and Russian Individuals in the UK

Depending on how the UK’s sanctions regime evolves, individuals and companies with links to or operations in Russia may also be affected either directly or indirectly. Research by Bowmore Asset Management concludes that more than 100 UK-listed companies have warned of the negative effects of the war in Ukraine, with few of them so far quantifying the impact on their earnings (Hesketh, 2022). Even before the invasion, some UK companies were warned of the effects of rising costs and supply chains unleashed by COVID-19 and even Brexit, but the war is now amplifying that impact and only making the situation worse.

UK manufacturers are facing an abrupt increase in costs as the Russian invasion of Ukraine impairs the progress made towards fixing global supply chains before the conflict broke out. Experts worry that the conflict between Russia and Ukraine will eventually strike firms across Europe and lessen industrial production over the next few months; as the conflict has already prompted a leap in the prices of oil and gas, prolonging supply chain disruption (Partington, 2022).

Mike Thornton (Partington, 2022), the head of manufacturing at the accountancy firm RSM, stated: “As the Russia-Ukraine conflict unfolds, UK manufacturers should brace for some additional headwinds. The surge in energy prices is the most obvious for heavy industry.”

As of now, Chelsea Football Club (Steinberg, 2022) is in turmoil and uncertain about its future, especially after its Russian owner Roman Abramovich was hit with government sanctions and the mobile phone company Three suspended its sponsorship of the club. This is mainly due to Abramovich’s ties with Vladimir Putin as well as the Russian government. The UK government’s decision to freeze Abramovich’s assets – and temporarily prevent him from selling the club for the moment – has pushed Chelsea into a state of limbo. Many players are concerned about the direction of the club as well as their own futures and are yearning for clarity. One of the reasons they are alarmed is because one of the conditions that have emerged from the sanctions is that Chelsea is unauthorized to sign players or renew existing contracts. Three first-team players of the men’s team as well as five squad members of the women’s team have contracts that are set to end in the summer of 2022. Abramovich will now need the UK government’s consent to sell the Stamford Bridge club as he had previously intended.

Predictions on the UK’s Economic Growth Going Forward

The International Monetary Fund (IMF) estimates that UK economic growth will match that of the US in 2022 as the joint-fastest rate of GDP growth despite having its growth estimate cut from 4.7% to 3.7% (Jolly, 2022). However, the UK will sink to the bottom of the league table of comparable economies in the G7 at just 1.2%, nearly halving its previously predicted 2.3%.

The low UK growth rates forecast in 2023 are partly due to the UK recovering more quickly from the pandemic than other members of the G7. However, the UK must face a major setback from high inflation which will affect growth in 2023, as consumers spend less while their real income (adjusted for inflation) diminishes, stated the IMF. The organization expects inflation to reach a high of 9% in late 2022 (Jolly, 2022).

Moreover, it is also forecast that the UK will face the highest rate of inflation, particularly in food prices – a necessity good. This may lead to higher costs of living, more poverty and less output in the country. UK inflation is expected to be 5.3% in 2023 (Islam, 2022), which is the highest rate since 1991 (UK Historical Inflation Rates, 1988-2020), and is the highest in the G7 (Jolly, 2022), surpassing all EU members and only exceeded in the G20 by crisis-ridden Argentina, Turkey and Russia (Islam, 2022).

Conclusion

To summarize, the main objective of this research paper is to illustrate what sanctions are, how they have adversely affected Russia in recent months, and how the UK is affected by them. Over the past few decades, the political authorities of Russia have had firm connections with the UK economy. However, the recent sanctions imposed on Russia might lead to a more uncertain relationship between the two nations, which may cause economic uncertainty in the near future, particularly for the UK as this paper has investigated. As a result of a considerable portion of Russia’s assets being frozen and a sharp depreciation of the ruble, Russia’s economic power has been dampened, giving many Western countries a temporary sense of ease. However, it is important to realize the repercussions caused as a result of such sanctions, for example, how these sanctions have affected dependent manufacturers and Russian workers who are working abroad and particularly in the UK. Despite the UK’s efforts to improve its current account and improve the situation through different government policies, the rate of inflation continues to rise at an alarming rate in a way which will have a larger impact on low-income households in the country, causing them to suffer from: higher costs of production, higher costs of living and more poverty. Regardless of the outcome of the conflict, consumption and investment will be delayed globally, slowing down the recovery process from the pandemic all over the world.

Works Cited

Bartrum, O. (2022, March 3). Russia–Ukraine war: how could it affect the UK economy?

Www.instituteforgovernment.org.uk.

https://www.instituteforgovernment.org.uk/explainers/ukraine-war-uk-economy

BBC. (2019, October 16). What is the UK’s inflation rate? BBC News. https://www.bbc.com/news/business-12196322 [Accessed April 23, 2022]

Booth, W., Rauhala, E., & Birnbaum, M. (2022, April 9). What weapons to send to Ukraine? How debate shifted from helmets to tanks. Washington Post. https://www.washingtonpost.com/world/2022/04/09/nato-heavy-weapons-ukraine/

Broom, D. (2022, March 18). What else does Russia export, beyond oil and gas? World Economic Forum. https://www.weforum.org/agenda/2022/03/russia-gas-oil-exports-sanctions/ [Accessed April 30, 2022]

Bullough, O. (2022, March 4). In UK, wind shifts against Russian money. POLITICO. https://www.politico.eu/article/russia-united-kingdom-investment-oligarch-money-ukraine-war-vladimir-putin/ [Accessed April 30, 2022]

Constable, S. (2022, March 7). How Sanctions on Russia Will Hurt—and Help—the World’s Economies. Time. https://time.com/6155581/russia-sanctions-global-economic-impact/

Cygan, A., Disney, R., & Szyszczak, E. (2022, April 13). Sanctions on Russia: what are the ramifications of this new trade war? Economics Observatory. https://www.economicsobservatory.com/sanctions-on-russia-what-are-the-ramifications-of-this-new-trade-war

Diver, T. (2022, April 16). Public support for Russian sanctions dwindles as cost of living crisis takes its toll. The Telegraph. https://www.telegraph.co.uk/news/2022/04/16/public-support-russian-sanctions-dwindles-cost-living-crisis/ [Accessed April 23, 2022]

Economic Change in Russia | Center for Strategic and International Studies. (2010). Csis.org. https://www.csis.org/programs/russia-and-eurasia-program/archives/economic-change-russia [Accessed April 30, 2022]

EU trade relations with Russia. (n.d.). Policy.trade.ec.europa.eu. https://policy.trade.ec.europa.eu/eu-trade-relationships-country-and-region/countries-and-regions/russia_en [Accessed April 30, 2022]

Ferreira, J. (2021, March 29). UK Q4 GDP Growth Confirmed at 0.2%. Tradingeconomics.com; TRADING ECONOMICS. https://tradingeconomics.com/united-kingdom/gdp-growth [Accessed April 30, 2022]

Harari, D., Devine, B. F., Bolton, P., & Keep, M. (n.d.). Rising cost of living in the UK. House of Commons Library. Retrieved April 30, 2022, from https://researchbriefings.files.parliament.uk/documents/CBP-9428/CBP-9428.pdf [Accessed April 23, 2022]

Harris, J. (2022, March 6). Oligarch money is embedded in London. Beware the big talk of a “crackdown” John Harris. The Guardian. https://www.theguardian.com/commentisfree/2022/mar/06/oligarch-money-is-embedded-in-london-beware-the-big-talk-of-a-crackdown [Accessed April 30, 2022]

Hess, M. (2022, March 31). What will Russia’s post-invasion economy look like? Www.aljazeera.com. https://www.aljazeera.com/opinions/2022/3/31/russias-post-invasion-political-economy

Hesketh, R. (2022, March 20). More Than 100 U.K.-Listed Companies Warn on Ukraine War Impact. Bloomberg.com. https://www.bloomberg.com/news/articles/2022-03-20/more-than-100-u-k-listed-companies-warn-on-ukraine-war-impact

Islam, F. (2022, April 19). UK set for slowest growth in G7 as Ukraine war hits global economy. BBC News. https://www.bbc.com/news/business-61142906

Inman, P. (2022, February 26). What is Swift and what will shutting Russia out of it achieve? The Guardian. https://www.theguardian.com/technology/2022/feb/24/what-is-swift-international-payments-network-russia-sanction

Jeong, A. (2022, March 15). Putin has brought threat of nuclear conflict “back within the realm of possibility,” U.N. chief says. Washington Post. https://www.washingtonpost.com/world/2022/03/15/nuclear-conflict-putin-un-guterres/

Jolly, J. (2022, April 19). UK GDP growth to slow to worst in G7 in 2023, says IMF – as it happened. The Guardian. https://www.theguardian.com/business/live/2022/apr/19/imf-global-growth-gdp-forecast-russia-ukraine-invasion-inflation-elon-musk-twitter-uk-gdp-ftse-100-business-live

Meadway, J. (2022, February 28). Central banks as weapons: how the West learned from the eurozone crisis. Pandemic Capitalism. https://jamesmeadway.substack.com/p/central-banks-as-weapons-how-the?utm_source=url&s=r

Mills, C. (2022, April 28). Sanctions against Russia. UK Parliament. https://commonslibrary.parliament.uk/research-briefings/cbp-9481/ [Accessed April 30, 2022]

Nice, A. (2022, March 15). StackPath. Www.institute for government.org.uk. https://www.instituteforgovernment.org.uk/explainers/sanctions

Partington, R. (2022, March 1). UK manufacturers face higher costs as Ukraine crisis hits supply chains. The Guardian. https://www.theguardian.com/business/2022/mar/01/uk-manufacturers-face-higher-costs-as-ukraine-crisis-hits-supply-chains

Russia: Borders closed to foreign nationals. (2022, March 17). B a L | Berry Appleman & Leiden LLP. https://www.bal.com/bal-news/russia-borders-closed-to-foreign-nationals/

Steinberg, J., Ingle, S., & Hytner, D. (2022, March 10). Chelsea players fearful for future after UK freezes Abramovich’s assets. The Guardian. https://www.theguardian.com/football/2022/mar/10/roman-abramovich-unable-to-sell-chelsea-after-uk-freezes-assets

Studies, the C. for S. (2020, June 8). Oil Price and Russia’s Economy. https://isnblog.ethz.ch/economy/oil-price-and-russias-economy [Accessed April 30, 2022]

Swinford, Cherwell, Waterfield, S., Philip, Bruno. (2014, March 3). Ukraine crisis: UK prepares to rule out sanctions against Russia amid threat to global economy. Www.telegraph.co.uk. https://www.telegraph.co.uk/news/worldnews/europe/ukraine/10674503/Ukraine-crisis-UK-prepares-to-rule-out-sanctions-on-Russia-amid-threat-to-global-economy.html [Accessed April 30, 2022]

Tracey, G. (2018). How the 2014 Economic Crisis Changed Russia’s Economy. GeoHistory. https://geohistory.today/2014-crisis-russia-economy/ [Accessed April 30, 2022]

UK Historical Inflation Rates – 1988 to 2020. (2022, April 13). Www.rateinflation.com. https://www.rateinflation.com/inflation-rate/uk-historical-inflation-rate/

Watt, N. (2014, March 18). Ukraine: UK to push for tougher sanctions against Russia over Crimea. The Guardian. https://www.theguardian.com/world/2014/mar/18/ukraine-uk-push-sanctions-russia-crimea [Accessed April 30, 2022]

War and sanctions means higher inflation. (2022, March 5). The Economist. https://www.economist.com/finance-and-economics/2022/03/05/war-and-sanctions-means-higher-inflation [Accessed April 23, 2022]

What are Economic Sanctions? (n.d.). Dow Jones Professional. https://www.dowjones.com/professional/risk/glossary/sanctions/ [Accessed April 30, 2022]